Business Entity Formation & Startup Legal Counsel

Starting a Business or Seeking Startup Legal Advise? Call (916) 550-2688

Business Entity Formation | Choosing the Best Business Structure for Your Company

The decision to start a new business in Northern California is a major accomplishment, but it is only the beginning. Choosing the best way to structure your new business can have as much of an impact on your success as what type of products or services you are offering. This is true for both for-profit companies and nonprofit organizations. Our law firm has successfully helped many eager entrepreneurs navigate the business formation process.

As a business owner, you can potentially be exposed to the debts and liabilities related to your business. Choosing the right business entity and formally registering your company can help to limit your personal exposure. There are many types of business entities available for your new business, and hiring an experienced business formation attorney is the best way to choose the best business structure for you.

Business Entities for Startups and Entrepreneurs

There are many types of business entities available to structure your business. Each business structure provides unique benefits and limitations. Our business attorneys will provide you with the best legal advice to decide which business entity is right for you. The most common for-profit types of business entities are described below.

Sole Proprietorship

As the name suggests, a sole proprietorship is a business owned and run by one person. The benefits of choosing a sole proprietorship for your business formation are the low costs and ease of setup. If the business name is the same as your name, there are very few legal forms you will need to file depending on your industry. The disadvantages of choosing to use a sole proprietorship for your business entity primarily revolve around your liability. As an unincorporated business, there is no legal separation between yourself and the company. You are personally liable for all activities related to the business, including all expenses, debts, and business tax obligations.

As the name suggests, a sole proprietorship is a business owned and run by one person. The benefits of choosing a sole proprietorship for your business formation are the low costs and ease of setup. If the business name is the same as your name, there are very few legal forms you will need to file depending on your industry. The disadvantages of choosing to use a sole proprietorship for your business entity primarily revolve around your liability. As an unincorporated business, there is no legal separation between yourself and the company. You are personally liable for all activities related to the business, including all expenses, debts, and business tax obligations.Schedule A Sole Proprietorship

Business Formation Consultation Today. Contact Us Today.

General Partnership

A General Partnership is a similar business entity to a sole proprietorship. The primary difference is that a general partnership requires two or more people conducting business as co-owners. The partnership can be automatically started when the partners work in concert with each other for the purpose of doing business or through drafting a partnership agreement. There are a few additional legal documents that need to be filed for a general partnership. These legal forms can include a fictitious business name, federal tax ID, and business license. While a general partnership is relatively easy and inexpensive to set up, there are disadvantages with this type of business formation. The liability of each partner is unlimited, not only for the partner’s own contribution to the business or individual actions, but those of the other partners as well. Like a sole proprietorship, these obligations can include, but are not limited to:

A General Partnership is a similar business entity to a sole proprietorship. The primary difference is that a general partnership requires two or more people conducting business as co-owners. The partnership can be automatically started when the partners work in concert with each other for the purpose of doing business or through drafting a partnership agreement. There are a few additional legal documents that need to be filed for a general partnership. These legal forms can include a fictitious business name, federal tax ID, and business license. While a general partnership is relatively easy and inexpensive to set up, there are disadvantages with this type of business formation. The liability of each partner is unlimited, not only for the partner’s own contribution to the business or individual actions, but those of the other partners as well. Like a sole proprietorship, these obligations can include, but are not limited to:- Ownership of all expenses

- Responsibility of accrued debts

- Business taxes brought on to the company by any of the partners

This makes a general partnership a risky business entity. Additionally, if one partner leaves the business, the partnership is dissolved and a new business entity will need to be created.

Schedule A General Partnership Business Formation Consultation Today. Contact Us Today.

C Corporation

A C Corporation, also referred to as a C Corp, is a separate legal entity from the owners. The owners of the corporation are referred to as stockholders or shareholders. There are many benefits for choosing a C Corp for your business entity. The C Corporation is responsible for its own debts and obligations. Additionally, this business type has perpetual existence, meaning the corporation will continue to exist even if all its owners leave or die. Additional owners or investors can be brought into the corporation by issuing shares of various forms with various preferences. This business structure separates the ownership and management of the company with a very structured governance. The stockholders elect directors who are responsible for making the business decisions for the corporation. This separation, gives a C Corp the ability to shield each owner from personal liability. This benefit, alongside ease of transferring ownership, make a C Corp a preferred business entity for venture capital funds and passive investors alike. However, a C Corporation functions as a separate taxable entity which presents the biggest disadvantage. Earnings are taxed twice, also referred to as double taxation, once at the entry-level and once at the stockholder-level on dividends. The process for forming a C Corporation requires the creation and filing of more legal documents than a sole proprietorship or general partnership, both for the creation of the corporation and ongoing. The best way to ensure the C Corp is properly formed is by seeking legal advice from an experienced business formation attorney.

A C Corporation, also referred to as a C Corp, is a separate legal entity from the owners. The owners of the corporation are referred to as stockholders or shareholders. There are many benefits for choosing a C Corp for your business entity. The C Corporation is responsible for its own debts and obligations. Additionally, this business type has perpetual existence, meaning the corporation will continue to exist even if all its owners leave or die. Additional owners or investors can be brought into the corporation by issuing shares of various forms with various preferences. This business structure separates the ownership and management of the company with a very structured governance. The stockholders elect directors who are responsible for making the business decisions for the corporation. This separation, gives a C Corp the ability to shield each owner from personal liability. This benefit, alongside ease of transferring ownership, make a C Corp a preferred business entity for venture capital funds and passive investors alike. However, a C Corporation functions as a separate taxable entity which presents the biggest disadvantage. Earnings are taxed twice, also referred to as double taxation, once at the entry-level and once at the stockholder-level on dividends. The process for forming a C Corporation requires the creation and filing of more legal documents than a sole proprietorship or general partnership, both for the creation of the corporation and ongoing. The best way to ensure the C Corp is properly formed is by seeking legal advice from an experienced business formation attorney.Schedule A C Corporation

Business Formation Consultation Today. Contact Us Today.

S Corporation

An S Corporation, also referred to as an S Corp or an IRS subchapter-S, is very similar to a C Corporation. The S Corporation’s main benefit is how the business tax plan is structured. The corporation has a flow-through tax structure where income is only taxed once at the shareholders disbursement. There are some limitations of a S Corporation business structure. The total number of shareholders are limited to 100. Shareholders must be either individuals, certain tax-exempt organizations and trusts. This can pose a problem for many funds to invest in the business as they usually do not fall within these constraints. Additionally, the corporation can only issue one class of stock to investors. The corporation cannot offer cheaper stock to employees and preferred stock to investors. Like a C Corp, forming an S Corp requires the creation and filing of many legal documents, both for the creation of the corporation and ongoing. Seeking legal advice from an experienced business formation attorney is the best way to ensure the S Corp is properly formed. This is where we can help you.

An S Corporation, also referred to as an S Corp or an IRS subchapter-S, is very similar to a C Corporation. The S Corporation’s main benefit is how the business tax plan is structured. The corporation has a flow-through tax structure where income is only taxed once at the shareholders disbursement. There are some limitations of a S Corporation business structure. The total number of shareholders are limited to 100. Shareholders must be either individuals, certain tax-exempt organizations and trusts. This can pose a problem for many funds to invest in the business as they usually do not fall within these constraints. Additionally, the corporation can only issue one class of stock to investors. The corporation cannot offer cheaper stock to employees and preferred stock to investors. Like a C Corp, forming an S Corp requires the creation and filing of many legal documents, both for the creation of the corporation and ongoing. Seeking legal advice from an experienced business formation attorney is the best way to ensure the S Corp is properly formed. This is where we can help you.Schedule A S Corporation

Business Formation Consultation Today. Contact Us Today.

Limited Liability Partnership (LLP)

A Limited Liability Partnership, or LLP, is a variation of a general partnership. The LLP consists of general partners and limited partners. The general partners manage the business and are liable for all debts and obligations. The limited partners usually contribute capital and only assume limited liability. A LLP is a popular choice of entity for partnerships where one or more partners want to retain control of the business decisions but would like to bring on additional investors. All partners benefit from a flow-through tax structure where each partner is taxed individually. With an LLP, you want to make certain that there is a solid, legally binding partnership agreement in place. An experienced LLP business formation law office can provide you with the legal advice and guidance in setting up your LLP.

A Limited Liability Partnership, or LLP, is a variation of a general partnership. The LLP consists of general partners and limited partners. The general partners manage the business and are liable for all debts and obligations. The limited partners usually contribute capital and only assume limited liability. A LLP is a popular choice of entity for partnerships where one or more partners want to retain control of the business decisions but would like to bring on additional investors. All partners benefit from a flow-through tax structure where each partner is taxed individually. With an LLP, you want to make certain that there is a solid, legally binding partnership agreement in place. An experienced LLP business formation law office can provide you with the legal advice and guidance in setting up your LLP.Schedule A Limited Liability

Partnership Business Formation Consultation Today. Contact Us Today.

Limited Liability Company LLC

A Limited Liability Company, also referred to as an LLC, combines many of the benefits of general partnerships and corporation business entities. An LLC can be easier to set up than a C Corporation or S Corporation while still providing owners limited liability. Like a general partnership, shareholders benefit from single taxation. The biggest disadvantage of an LLC comes from limitations on who can invest in the company. Restrictions on investments from venture capitalists can limit potential investments in the company. The business formation process for an LLC requires filing many legal documents, including the Articles of Incorporation. An operating agreement is also created that defines profit sharing, decision-making, and the allocation of interest amongst members. Hiring a law firm that is experienced in business formation for Limited Liability Companies will give you the legal advice needed to successfully set up your business entity.

A Limited Liability Company, also referred to as an LLC, combines many of the benefits of general partnerships and corporation business entities. An LLC can be easier to set up than a C Corporation or S Corporation while still providing owners limited liability. Like a general partnership, shareholders benefit from single taxation. The biggest disadvantage of an LLC comes from limitations on who can invest in the company. Restrictions on investments from venture capitalists can limit potential investments in the company. The business formation process for an LLC requires filing many legal documents, including the Articles of Incorporation. An operating agreement is also created that defines profit sharing, decision-making, and the allocation of interest amongst members. Hiring a law firm that is experienced in business formation for Limited Liability Companies will give you the legal advice needed to successfully set up your business entity.Schedule A Limited Liability

Company Business Formation Consultation Today. Contact Us Today.

Public Benefit Corporation

A Public Benefit Corporation, referred to in California as a California Benefit Corporation was created by the Corporate Flexibility Act of 2011. Benefit Corporations were specifically designed to allow social enterprises to pursue both for-profit and non-profit purposes. While similar to the business structure of a C Corporation, a Benefit Corporation allows corporate officers and directors to consider the triple bottom line of profit in decision making. There are three primary features that differentiate a California Benefit Corporation from a C Corp:

A Public Benefit Corporation, referred to in California as a California Benefit Corporation was created by the Corporate Flexibility Act of 2011. Benefit Corporations were specifically designed to allow social enterprises to pursue both for-profit and non-profit purposes. While similar to the business structure of a C Corporation, a Benefit Corporation allows corporate officers and directors to consider the triple bottom line of profit in decision making. There are three primary features that differentiate a California Benefit Corporation from a C Corp:- Requirement of a public benefit purpose

- Directors have greater protection from shareholders to pursue the triple bottom line

- Transparency and accountability enforcement

To summarize these features: The California Benefit Corporation’s Articles of Incorporation must state they are a Benefit Corporation with one purpose to create a general public benefit. The shareholders’ interests are not given priority above the other parts of the triple bottom line of profit, people, and planet. This allows the board of directors to make decisions that may advance the public benefit purpose but not the shareholders profits. To ensure transparency and accountability enforcement the company must fulfill three checks: a third-party assessment standard, annual benefit report, and a benefit enforcement proceeding. Choosing to establish your business as a California Benefit Corporation is a great social commitment. However, there are many specific legal requirements that must be understood and followed for this business type. Hiring an experienced business formation lawyer to complete and file all of the necessary legal documents allows you to focus your time and energy on what you do best, run the company and better society.

Schedule A Public Benefit

Corporation Business Formation Consultation Today. Contact Us Today.

Request a Legal Consultation

Fill out the form below to receive a confidential initial consultation.

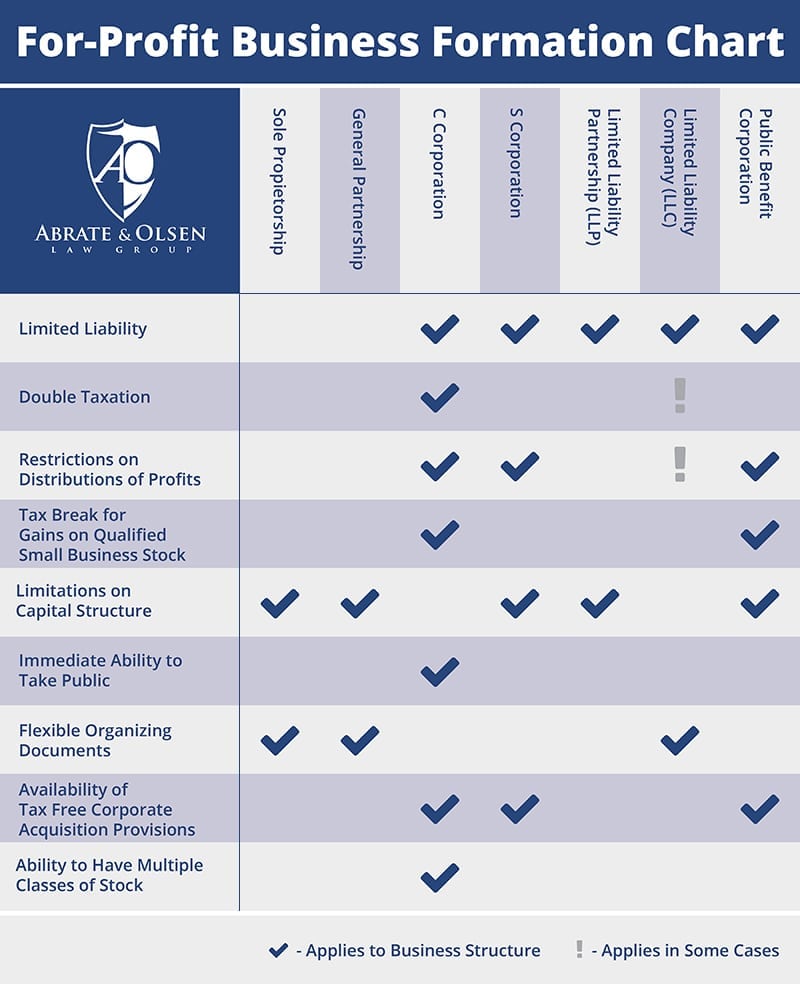

Choosing the Right Business Formation for Your For-Profit Company

Each type of business formation provides your company with various benefits and limitations. Understanding how each option could impact your business and choosing the best business structure is the first step in laying a solid foundation to build your company on. Here is a quick reference chart with some of the most common differences.

Business Formation Review

Five Stars

“After meeting with Mike Abrate about forming my business, he was able to explain the benefits of setting my company up as an LLC over a Sole Proprietorship. The benefits of the LLC will not only save me money, but protect my family and I.”

– Ben M. Sacramento, CA

Business Entities for Nonprofit Organizations

An organization that works for the betterment of society, the environment, or a select group of people may be eligible to be considered a not-for-profit or nonprofit organization. While the organization is generally structured as a corporation, the organization is not owned by individuals or shareholders. Our law firm is experienced with the many types of business entities that are available for your nonprofit business. The most common types of not-for-profit business structures are outlined below.

An organization that works for the betterment of society, the environment, or a select group of people may be eligible to be considered a not-for-profit or nonprofit organization. While the organization is generally structured as a corporation, the organization is not owned by individuals or shareholders. Our law firm is experienced with the many types of business entities that are available for your nonprofit business. The most common types of not-for-profit business structures are outlined below.

Public Benefit Nonprofit Corporation

Public Benefit Nonprofit

Corporation Business Formation Consultation. Contact Us Today.

Mutual Benefit Nonprofit Corporation

Mutual Benefit Nonprofit

Corporation Business Formation Consultation. Contact Us Today.

Private Foundation

- The Foundation’s Mission

- The Foundation’s Board

- The Investment of Funds

- The Disbursement of Funds

Like a corporation, a foundation can be set up with the intent to exist in perpetuity, continuing to benefit your cause into the future.

Private Foundation

Corporation Business Formation Consultation. Contact Us Today.

501(c) and 501(c)(3) Tax Exemption

- Establishing a specific purpose clause

- More than one initial director

- Special language regulating how corporate matters are handled*

- Prohibition of self-dealing*

- Prohibition of engaging in propaganda or attempting to influence legislation or elections*

*For charitable organizations If the IRS approves the application for tax-exempt status for a charitable organization, donors to the organization may deduct their contributions from their personal or corporate taxes. Understanding which type of business structure to use for your nonprofit organization can depend on many factors, including mission, target beneficiary, federal rules and state laws just to name a few. Hiring a legal team that is experienced with nonprofit business formation can offer you the legal advice and guidance to ensure that your nonprofit follows all the federal and state regulations.

Learn More About Setting Up Your

501(c) or 501(c)(3) Tax Exemption. Contact Us Today.

Starting a New Business? We’re the Entity Formation Legal Experts You Need!

Business Formation Legal Counsel Tailored for Your Business Needs and Goals

There are many business entity options available to consider when forming your business structure. Our experienced business formation attorneys will guide you through the process of deciding what business entity type will best achieve the business goals and needs of your new company.

You can rest assured that we will thoroughly explain the benefits of all business entities available to you. We will detail how each business formation will affect your liability, you and your business will be taxed, ability to grow your business, bring on additional partners and raise capital.

Schedule a legal consultation with our business formation attorneys toady to review the unique business needs and goals of your new company today.